June Market Update 2025

This month we discuss the US market rally and the Israel-Iran conflict, the latest developments in US trade policy, and NATO’s generational commitment to defence.

Our In Conversation With series shares personal and thought-provoking insights from inspiring individuals across diverse industries and backgrounds. It provides practical perspectives on how different forms of capital — intellectual, social, and financial — can be harnessed to drive innovation, growth, and meaningful change, while also offering investors valuable insights into the key trends shaping different sectors.

This time, Neil Benjelloun, Bedrock’s Head of Private Markets, hosted a live Q&A session with Michael Lunt (Mike) from OA Private Capital and co-lead of RidgeLake Partners, to explore the intriguing and relatively unexplored segment of the market that is GP Stakes Investing.

Growing interest in General Partner (GP) stakes investing is evident, with a recent survey among Limited Partners (LPs) revealing that 49% are currently investing in or planning to invest in GP stakes funds in 2024, up from 33% in 2021.[1]

For nearly two decades, Mike has helped manage the private equity portfolio of RDV Corporation, the family office of Richard and Helen DeVos, one of the founding families of Amway. In 2015, RDV formed OA Private Capital (OA) to oversee the private equity and other certain alternative assets of the DeVos family and select third-party clients. Today, OA manages over $17 billion across fund commitments, co-investments, credit, secondaries, and GP stakes. In 2020, RidgeLake Partners was launched as a joint venture between OA and Apogem Capital to pursue GP stakes investing through an inaugural $1.1 billion fund which held its final close in 2023.

GP stakes investing refers to the practice of investing in the management companies of private equity, venture capital, or other private funds, rather than investing in the funds themselves. This typically involves acquiring a minority interest in the management company (the GP) that earns fees and carried interest from the funds it manages. This type of investment is designed to provide investors with exposure to the management company’s future earnings and growth potential.

GP stakes investing has been around for several years, but it gained significant traction and visibility in the investment community over the last decade. Prior to 2018, over 60% of private equity minority stakes were sold by firms with $10 billion+ in assets under management (AUM), creating the appearance that GP stakes transactions were reserved for larger asset managers. However today, an increasing number of GP stakes transactions are being completed with middle market GPs (generally, GPs with $1 billion to $10 billion of AUM), as these GPs recognize the potential benefits of adding a minority partner [2].

Q: [Neil] Can you give us a glimpse into OA’s history and how that has led you to GP stakes investing?

A: [Mike] Certainly. Our family office was founded about 30 years ago and for the last 20 plus years or so, our focus has been on private equity via a partnership model; that is, investing exclusively through GPs.

“GPs, as it turned out, were quite profitable, running at 50% profit margins on management fee income.”

Our foray into GP stakes began in 2015 when one of our existing GPs received an investment from a GP stakes firm and our GP invited us to participate in the transaction. While it was our first GP stakes investment, we recognized it as an intriguing opportunity. GPs, as it turned out, were quite profitable, often running at 50%+ profit margins on management fee income. This prompted us to explore the opportunity even further, with this first investment helping us to delve deeper into GP operations, cash flows, and balance sheets.

Said another way, this was a chance for us to expand from being LPs, co-investors, and occasional secondary buyers, to seeing what it’s like to be an owner of a GP. Between 2015 and 2019, we expanded our GP stakes portfolio by offering GP stakes growth capital to a subset of our other existing managers. Our aim was not to provide personal enrichment for the GPs, but to invest in their businesses while letting them retain control. For us, GP stakes investing has been a strategic fit for our portfolios, offering added yield and long-term growth potential.

Q: [Neil] There seems to be a strong link between private wealth and GP stakes investing. Why do you think private individuals and family offices find this part of the market so appealing?

A: [Mike] There’s an underlying belief, from our perspective, in the power of private markets as a means to access superior risk-adjusted performance. We believe GP stakes investing is not a drastic departure but rather a natural extension to a well-balanced private markets program. In essence, it’s about finding an opportunity that aligns with your risk appetite and return expectations.

“GP stakes portfolios are more of a long-term hold, with less turnover of exposure compared to fund or co-investment portfolio. It occupies more of a middle ground in the risk-reward spectrum, sitting between senior credit and venture.”

In fact, in our pre-RidgeLake portfolio, we’ve enjoyed solid cash yields over the past several years. We find that family offices like ours appreciate the opportunity for current income combined with growth in the underlying investments. The multifaceted nature of GP stakes allows it to blend different aspects, offering a balanced risk-reward profile, which we think high net worth families in particular are drawn to. We believe it complements well their overall investment strategies.

The market is evolving as more participants engage, and there’s an increasing understanding of the dynamics. However, it’s a nuanced landscape that demands a strategic and patient approach.

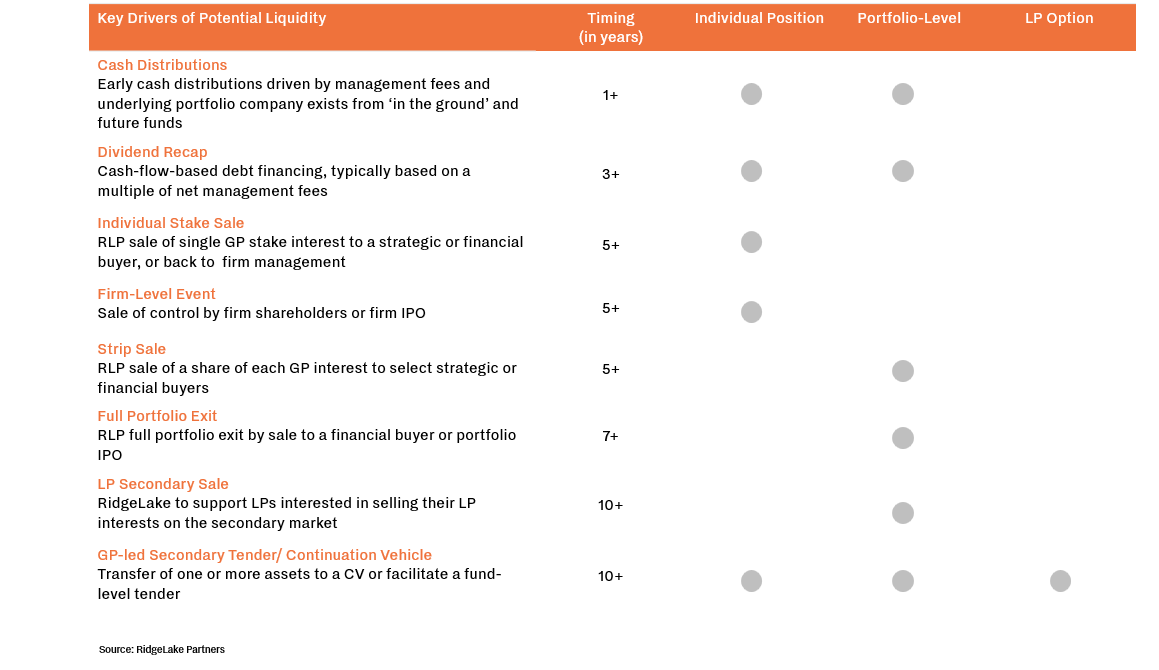

Q: [Neil] Given the inherently longer-term hold, what exit routes can a GP stakes investor reasonably depend on to return capital to LPs?

A: [Mike] From our viewpoint, these are seen as long-term assets. As a GP, we must address the liquidity question for LPs in our fund, but our position is that if these assets are performing well, why not retain them? However, circumstances can change. For example, the next generation at a family office might wish to explore different avenues, or personal goals may shift. While GP stakes funds generally do not have a finite term, the practical nature of the portfolio management creates the desire for an exit point (or at least an option to exit). In such cases, liquidity becomes a real consideration.

Let’s walk through the liquidity journey chronologically. Cash distributions begin accruing immediately, as these are profitable businesses with management fees providing a steady income stream. By making a GP stakes investment, you typically buy an interest of the returns from all or substantially all of assets in the ground, not just the manager’s latest fund, allowing you to de-risk capital early as older funds liquidate investments. This itself represents a partial realization/liquidity event. Other considerations can be to do a strip sale of the portfolio to a financial investor, like a sovereign wealth fund or a life insurance company, offering them diversified exposure without the hassle of building a portfolio from scratch. Alternatively, a sale of control by the underlying firm’s majority shareholders or a public listing are viable liquidity options. In less favorable scenarios, secondary market transactions may be necessary.

Q: [Neil] When you hear of a GP stakes buyer acquiring a minority stake in a GP, as an LP, you tend to worry about the potential for the dilution of economics and misalignment of interests. Is this worry misguided?

A: [Mike] It’s a valid concern. You’re indeed taking a piece of the carry when investing in the management company. However, let’s shift the perspective from percentages to dollars. It’s a smaller slice of a bigger pie mentality. Imagine a firm’s fund sizes growing from $1 billion to $1.4 billion to $1.8 billion.

Historically, the GP will commit 2-5% of this capital into their funds, and as they expand, the cash needed to make that GP commitment grows substantially. In many transactions, we see the vast majority of our investment dollars used by the GP to help them keep up with this commitment alongside their LPs. This means more money is injected into the system rather than ending up in a partner’s personal bank account. It’s a matter of keeping pace. The team understands that this investment allows for an increased GP commit, aligning with LPs and ensuring continuous fund size growth. In the end, owning 5% of the carry of a larger fund is more incentivizing than 7% of the carry of a medium-sized fund.

Many GPs also create long-term incentive plans, involving bringing key team members into the ownership of the management company. It’s crucial to manage this process carefully – upsetting the team or disappointing LPs can have detrimental effects. If a GP stakes investment creates misalignment, then it wasn’t done right.

As private equity tends to be lumpy, given the variability in raising capital and exiting investments, valuation methodologies for GP stakes investing will not usually use a multiples-based approach.

Q: [Neil] Do your valuation methodologies across GP stakes investing differ from traditional methods?

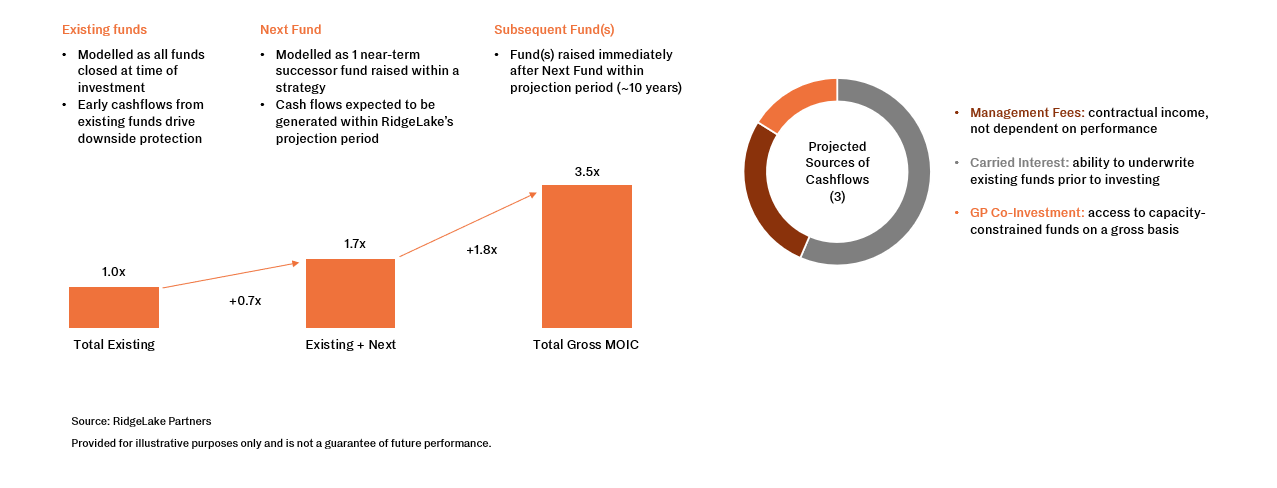

A: [Mike] Yes, we don’t look at just a one year forward or backward cash flow multiple; instead, we take a holistic 10-year discounted cash flow approach. When valuating these firms, we consider three main income streams: management fees, carried interest, and GP commitments. Each stream is discounted at varying rates.

Internally, we reassess every six months, considering new risks or developments. Post-investment, ongoing conversations, CFO-level discussions, and updates help us understand their plans and our projected cash flows.

Projected Sources of Gross Return Type and Fund (1)(2) – Sample GP Stakes Investment | Multiple Based on Committed Capital

Q: [Neil] Regarding diligence, given your history in making fund commitments and now with GP stakes, how does the diligence process differ?

A: [Mike] When looking at it from the perspective of the LP, the primary concern lies in the next four years of the investment period, the value creation team and process, and the exit strategy for their portfolio companies. If there’s a managing partner in their 60s with one fund left, it might be acceptable from an LP perspective. However, from the viewpoint of a GP stakes investor, it is important to delve into who constitutes the next generation of partners. Are they as competent? Do they have a proven track record in creating value? Equally crucial, have they been effectively engaging with LPs and involved in raising funds? One significant risk we identify is when a private equity firm, say, 20 years old, still relies on the same three managing partners for investor relations. While it may be a great fund, it poses challenges to becoming a great firm without transitioning those relationships. This aspect involves more art than science, but it underscores a long-term perspective.

We need assurance that the next generation can handle both the investment side as well as the running the business. Having been customers in the past and now transitioning to investors, our perspective is informed by what resonated with us as LPs. If we sense any inconsistencies or questionable sustainability in a GP’s future planning, it raises concerns for a GP stakes investment.

Our informal litmus test is rooted in the time spent as their customer and the expectations they set while pitching to us as LPs. If it aligns positively, it bodes well for their future capital-raising efforts, making it an excellent fit for GP stakes. However, if red flags emerge, we might question their ability to secure future funds.

So, what makes GP stakes investing attractive?

GP stakes investing is a nascent but attractive part of the private market universe as it offers the opportunity for strong risk-adjusted returns, providing downside protection through the de-risking effect of high current cash yields from contractual management fee earnings, coupled with the potential for outsized returns through performance fee earnings.

Investors also find it attractive given:

If you have any questions about the private markets or the themes discussed in this article, please do not hesitate to get in contact with us, here.

Neil Benjelloun

– Head of Private Markets, Bedrock

Neil joined Bedrock Group in 2023 from Cambridge Associates (CA), a global investment firm specializing in private market fund investing.

While at CA, Neil was an Associate Investment Director advising Middle Eastern family offices, pension funds, and other institutional investors on their private market portfolios. Prior to beginning his professional career, Neil moved to London from Morocco to pursue an undergraduate degree at University College London (UCL) and a postgraduate degree at Imperial College Business School.

Michael P. Lunt

– Managing Director, OA Private Capital; co-lead of RidgeLake Partners

Mike is Managing Director of OA Private Capital, serving as the portfolio manager for OA Private Capital’s GP stakes investment program. In addition, Mr. Lunt is the co-lead of RidgeLake Partners the middle market GP stakes investment platform co-managed by OA Private Capital and Apogem Capital (“RidgeLake”), including transaction sourcing, structuring, negotiating, divesting, and working with RidgeLake portfolio companies and RidgeLake investors. He is a member of the RidgeLake Investment Committee.

Sources

[1] Private equity international’s LP Perspectives 2024 Study

[2] PitchBook and Preqin

[3] Preqin,“FutureofAlternatives2027”report;publishedOctober2022

[4] In an effort to provide additional clarity, this suggests that Limited Partners in the GP Stakes Fund may have opportunities to commit to partner GPs’ under lying funds (vs. a direct GP Stakes co-investment).There is no guarantee these opportunities will be made available and a prospective investor should review the Fund’s offering memorandum in its entirety for additional information.

Important Legal Information

This document has been approved and issued by Bedrock SA licensed under Swiss Law, authorised by the Swiss Financial Market Supervisory Authority (FINMA) and supervised by the AOOS; Bedrock Monaco SAM authorised and regulated by the Commission for the Control of Financial Activities (“CCAF”); and Bedrock Asset Management (UK) Ltd. authorised and regulated by the Financial Conduct Authority in the UK (jointly, hereafter, “Bedrock”).

The information and opinions contained in this document are provided for background information and discussion purposes only and do not purport to be full or complete. No information in this document should be construed as providing financial, investment or other professional advice. This information contained herein is for the sole use of its intended recipient and may not be copied or otherwise distributed or published without Bedrock’s express consent. No reliance may be placed for any purpose on the information contained in this document or their accuracy or completeness. Information included in this document is intended for those investors who meet the Financial Conduct Authority definition of Professional Client or Eligible Counterparty or for those investors who meet the Swiss Federal Act on Financial Services Act (FinSA) of a Professional Client.

Investment risks

The value of all investments and the income derived from them can fluctuate due to market movements and you may not get back the amount originally invested. In the case of overseas investments, values may vary as a result of changes in currency exchange rates. This may be due, in part, to exchange rate fluctuations in investments that have an exposure to currencies other than the base currency of the portfolio. Investments in commercial buildings may prove illiquid in terms of the time taken to sell such assets. Past performance is no guide to or guarantee of future performance.

Alternative investments risks in general

As a professional client, you should be aware that investing in alternative investments can carry significant risks. Alternative investments are investments that do not fall under the traditional categories of stocks, bonds, and cash.

Examples of alternative investments include hedge funds, private equity, venture capital, and real estate.

Under the FCA financial promotions framework, alternative investments can only be promoted to professional clients, such as yourself. This is because professional clients are deemed to have the necessary knowledge and experience to understand the risks involved in these investments.

However, even with this level of expertise, it is important to be aware of the risks involved in alternative investments. Some of the risks include:

•Illiquidity: Alternative investments can be difficult to sell quickly, which means that you may not be able to access your money when you need it.

•Lack of transparency: Alternative investments are often less transparent than traditional investments, which means that it can be difficult to get a clear picture of the underlying assets and their performance.

•Complexity: Alternative investments can be complex, with unique features and structures that may be difficult to understand.

•Concentration risk: Alternative investments often require a large minimum investment, which means that you may end up with a concentrated portfolio and a high degree of exposure to a single investment.

•Higher fees: Alternative investments often come with higher fees than traditional investments, which can eat into your returns.

It is important to carefully consider these risks before investing in alternative investments. You should also ensure that you understand the terms of the investment, including any fees and charges, before committing your money.

If you have any questions or concerns about investing in alternative investments, you should seek the advice of a professional financial advisor who is qualified to advise on these types of investments.

Risks related to Private Equity (PE)

•Capital at risk: investment in PE carries a risk to the capital invested and that you may lose some or all of their capital invested.

•Illiquidity: investment in PE can be difficult to sell quickly, which means that you may not be able to access your money when you need it.

•Limited liquidity events: the investment in a PE may only provide limited liquidity events, such as partial or full company sales or mergers, and such events may not occur for several years.

•Unlisted security: the investment in a PE is an unlisted security and there is no established market for trading the shares.

Investment suitability: the investment in a PE may not be suitable for all you, and potential you should seek professional advice before investing.

•Concentration of investment: the investment in a PE will typically involve a concentration of assets and you should consider the risks associated with this.

•Complex structure: the investment in a PE may have a complex legal and tax structure, and you should seek professional advice to understand the risks associated with this.

•Fees and expenses: all fees and expenses associated with the investment in a PE, including management fees, performance fees, and other charges, and explain how these fees will be calculated and deducted.

•Regulatory risk: the investment in a PE may be subject to regulatory risk, and that changes in regulations could negatively impact the investment.

If you are considering investing in private you should carefully evaluate these risks, conduct thorough due diligence, and be prepared for longer investment horizons and potential illiquidity. Consulting with a qualified financial advisor or private market expert is essential to make informed investment decisions.